The Greatest Guide To Clark Wealth Partners

5 Simple Techniques For Clark Wealth Partners

Table of ContentsThe 15-Second Trick For Clark Wealth PartnersThe 45-Second Trick For Clark Wealth PartnersClark Wealth Partners Can Be Fun For EveryoneSome Known Factual Statements About Clark Wealth Partners Getting The Clark Wealth Partners To WorkHow Clark Wealth Partners can Save You Time, Stress, and Money.8 Easy Facts About Clark Wealth Partners DescribedThe Single Strategy To Use For Clark Wealth Partners

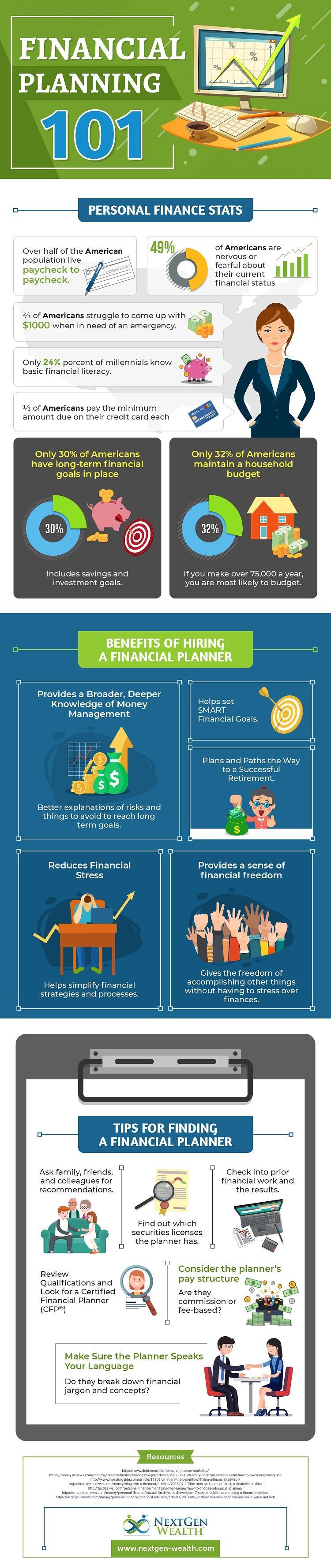

Typical factors to take into consideration an economic advisor are: If your monetary circumstance has come to be more complicated, or you lack self-confidence in your money-managing abilities. Saving or browsing major life occasions like marital relationship, separation, youngsters, inheritance, or work modification that might dramatically affect your economic scenario. Browsing the shift from conserving for retirement to protecting wealth throughout retired life and just how to create a solid retired life income strategy.New modern technology has led to more comprehensive automated monetary tools, like robo-advisors. It depends on you to check out and establish the best fit - https://pubhtml5.com/homepage/vqcdo/. Inevitably, a great economic consultant ought to be as conscious of your financial investments as they are with their very own, preventing too much fees, conserving money on taxes, and being as transparent as feasible about your gains and losses

Not known Details About Clark Wealth Partners

Gaining a payment on product recommendations doesn't always mean your fee-based consultant antagonizes your best passions. Yet they might be much more inclined to advise services and products on which they earn a commission, which might or might not be in your finest rate of interest. A fiduciary is lawfully bound to place their customer's passions first.

This standard allows them to make referrals for financial investments and services as long as they fit their client's goals, threat resistance, and financial scenario. On the other hand, fiduciary consultants are lawfully bound to act in their customer's best interest instead than their very own.

The Ultimate Guide To Clark Wealth Partners

ExperienceTessa reported on all things investing deep-diving right into complicated economic subjects, clarifying lesser-known investment avenues, and revealing ways readers can work the system to their advantage. As a personal money professional in her 20s, Tessa is really knowledgeable about the impacts time and uncertainty carry your investment decisions.

It was a targeted promotion, and it worked. Read more Check out much less.

Facts About Clark Wealth Partners Uncovered

There's no single course to ending up being one, with some people starting in banking or insurance, while others start in bookkeeping. 1Most economic coordinators begin with a bachelor's degree in finance, economics, bookkeeping, company, or a related subject. A four-year degree gives a solid foundation for professions in financial investments, budgeting, and customer service.

What Does Clark Wealth Partners Mean?

Usual examples include the FINRA Series 7 and Series 65 exams for protections, or a state-issued insurance license for marketing life or medical insurance. While qualifications might not be legitimately required for all intending functions, companies and customers frequently see them as a criteria of professionalism. We consider optional credentials in the following section.

Many financial coordinators have 1-3 years of experience and familiarity with financial items, compliance criteria, and direct client interaction. A strong instructional background is necessary, but experience demonstrates the capability to apply theory in real-world settings. Some programs combine both, permitting you to complete coursework while making monitored hours via teaching fellowships and practicums.

Clark Wealth Partners Things To Know Before You Get This

Early years can bring lengthy hours, pressure to develop a client base, and the need to constantly verify your competence. Financial coordinators enjoy the possibility to work very closely with clients, guide crucial life decisions, and frequently achieve versatility in schedules or self-employment.

They spent less time on the client-facing side of the market. Nearly all economic managers hold a bachelor's degree, and many have an MBA or similar graduate level.

The Single Strategy To Use For Clark Wealth Partners

Optional certifications, such as the CFP, typically call for added coursework and testing, which can prolong the timeline by a number of years. According to the Bureau of Labor Data, individual monetary experts earn a typical annual yearly salary of $102,140, with leading earners gaining over $239,000.

In other districts, there are policies that need them to meet specific demands to utilize the financial expert or economic planner titles. For monetary organizers, there are 3 usual designations: Licensed, Individual and Registered Financial Organizer.

Clark Wealth Partners for Beginners

Those on income might have a motivation to advertise the products and services their employers use. Where to discover a monetary consultant will depend upon the sort of advice you require. These organizations have personnel useful link who may aid you comprehend and buy specific types of financial investments. Term down payments, ensured financial investment certifications (GICs) and common funds.